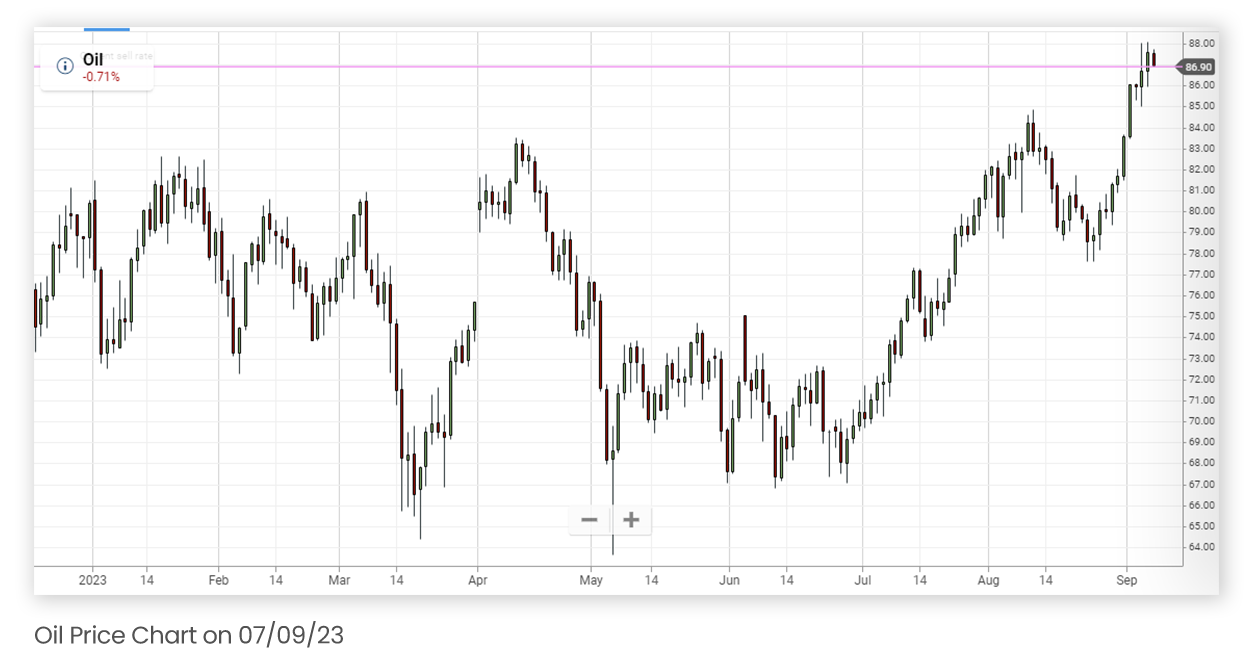

Crude Prices Soar to 10-Month High

By Wednesday, September 6, Crude Oil (CL) had recorded its longest streak of gains in over four years after posting nine consecutive sessions in the green. However, on the next morning, Thursday, prices retreated slightly.

WTI prices were driven largely by Russia and Saudi Arabia's commitment to extending their curbs on production to the end of the year. In addition, the American Petroleum Institute (API) contributed to Wednesday's gains after reporting a 5.5 million crude oil inventory drop. The official number is expected to be reported later on Thursday, September 7.

Mixed data from China also influenced the price of crude on Wednesday. Overall exports from the Asian giant fell by 8.8% in August, but crude imports saw an impressive boost of 30.9% compared to the same month last year.

However, Iran and Venezuela might increase production, which could offset some of the impact of the OPEC+ cuts and keep crude prices from rising.

API and OPEC+ Leaders Main Drivers

The commodity glued close to 10-month highs near $88 a barrel after the release of US inventory data from the API, as it was the latest data point adding to expectations that global crude supplies will be outstripped by demand later this year. The indication of a fourth consecutive week of falling stockpiles in the US came as refiners ramped up production, expecting strong demand for summer travel.

That was after prices had spiked to $88.02 per barrel on Tuesday following Saudi Arabia's announcement it would extend its voluntary production cut of 1M bbl/day until the end of the year. Russia also cut production by 300K bbl/day for the same period. Those cuts were on top of production cuts that had been agreed by OPEC+ back in April. Both countries said they would review market conditions to make monthly decisions on increasing or resuming production cuts.

The Effects On The Markets

The production cuts and subsequent rise in crude oil prices come at a crucial juncture for monetary policy, as they could potentially cause a rise in inflation. Analysts see the higher cost of crude as "potentially problematic" as the markets have gone from recession worries to hoping for a soft landing, with CPI data seen as moderating. The higher price of crude could undermine consumer confidence and add to inflation expectations.

Chinese imports have risen 14.7% in the first eight months of this year over the same period last year. Refiners in the Asian giant were seen building inventories as well as looking to book profits from exporting fuel. The daily rate of crude imports to China, the largest importer in the world, was at the third-highest ever in August.

According to analysts, the US has pretty low crude supplies, pointing to several weeks of large drawdowns in inventories. This includes the largest drawdown in US inventories since records began, which was reported at the end of July by the Energy Information Administration (EIA).

The near-term supply concerns also pushed the price of Brent (EB) 0.56% higher on Wednesday, with the price gap against WTI reaching near nine-month highs. The Dollar Index (DX) rose above a 6-month high in Wednesday trading, moderating some of the upward trajectory in crude as prices traded as high as $91.09 a barrel.

Where To From Here?

China's imports have increased over the last year as domestic fuel demand is no longer curbed by restrictions imposed to combat Covid. In fact, analysts see run rates at refineries continually growing. Moreover, August is the peak season for gasoline demand in China, as it coincides with the summer vacation period when travel demand is particularly high because it's the first season since the lifting of Covid restrictions.

Imports in China have surged despite the gloomy outlook for the broader economy, which weighs on domestic fuel demand. On top of that, exports of refined oil products have been rising as refiners look to gain profits from selling fuel overseas, with refined fuel exports rising 23.3% compared to the prior year.

Analysts see high diesel exports continuing as export margins remain good. However, some warn that a potentially strong dollar could weigh on crude demand as we advance as it makes oil more costly. Demand could also draw with US refiners heading into the usual September-October maintenance period. Other factors that could cap oil prices in the medium term include potentially higher supply from Iran, Venezuela and Libya.

Conclusion

Oil capped its nine consecutive day winning streak, the longest in more than four years on Thursday, after leading OPEC+ members extended supply curbs to the end of the year. The API reported a drawdown of 5.5M bbls of crude last week, with the official measure expected to be reported later on Thursday. Improving demand prospects have helped buoy prices as investors are looking for incremental optimism on China, the world's largest importer of crude.