This Week's Market Movers: RBA, Chinese Economy & Lagarde

Despite being in the early stages of September 2023, numerous events have already impacted the markets, providing insight into the global economy's performance. Here are this week’s market-moving events and what you can learn from them:

Chinese Economy in Focus Again

China has been making less-than-stellar headlines in the past couple of months as economic headwinds from deflation to issues in both the labor and property sectors put pressure on the nation’s economic growth, and today, Tuesday, September 5th, is no different.

Following the release of yet another disappointing Chinese economic report, further worries were raised about the future growth of the world’s second-largest economy. This is because, yesterday, China’s Caixin Purchasing Managers Index (PMI) was released today and showed further signs of struggle. This questionnaire-based index is sent to purchasing executives in over 400 private service sector companies to assess the health of the private sector economy. According to the results, in August, the Chinese services industry hit its “lowest level in eight months.” The numbers showed that the PMI fell to 51.8 in August compared to July’s 54.1.

The Caixin and S&P commented that “the slowdown in business activity coincided with a weaker increase in overall new business. New orders increased modestly, and at a pace that was below the average seen for 2023 to date.” In addition, weaker foreign demand for Chinese services was seen as the culprit. Additionally, it may be interesting to note that the data was not far from last week’s official PMI survey, which was released by the National Bureau of Statistics (NBS), and also showed a slowdown in service demand. Nonetheless, unline the official survey, the Caixin PMI puts further focus on smaller and private enterprises.

How Are the Markets Reacting Following the Chinese Release?

As fears of further weakness in the Chinese economy materialized, following the release of the disappointing PMI data in China, it seems that Asian markets are reacting negatively.

As of the time of the writing, Hong Kong’s Hang Seng Index (Hong Kong 50) fell by over 1.8% and China’s China A50 (CN) fell by 0.7%.

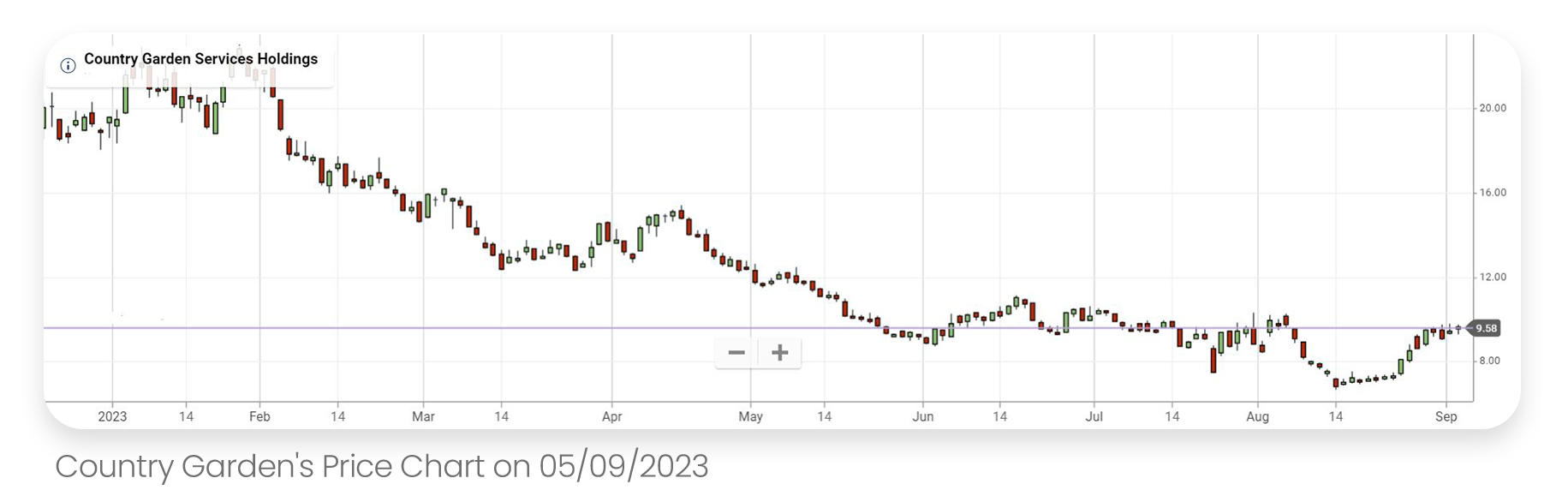

Moreover, China’s property market suffered further losses as shares of Chinese real-estate provider, Country Garden Services Holdings (6098. HK), which is facing Chinese economic headwinds and a potential default, fell by 2% on Tuesday.

Evidently, the property firm was deemed one of the most indebted in the world. It needs to pay over $22 million in dollar note interest before September 6th to redeem itself. Overall, since the beginning of the year, the Chinese property market has suffered and this is reflected in Country Garden’s loss of over 50% of its value since the beginning of the year up till today. (Source: Yahoo Finance)

Still, as there are additional data releases scheduled for this week, such as the Chinese Trade Balance data on Thursday and China's CPI on Friday, it would be worth monitoring their impact on the Chinese market and whether they bring about any positive changes.

RBA Keeps Rates Unchanged

As expected, Australia’s Central Bank, the Reserve Bank of Australia (RBA), met today, Tuesday, September 5th, and kept its cash rates at 4.10% (unchanged). One of the drivers for this decision is the global economic turmoil, which includes the Chinese situation. Accordingly, the RBA stated that “in light of this and the uncertainty surrounding the economic outlook, the board again decided to hold interest rates steady this month.” In addition, RBA Governor, Philip Lowe stated that “there is increased uncertainty around the outlook for the Chinese economy due to ongoing stresses in the property market.”

The bank also elaborated that the decision to put rates on hold can help them assess whether or not the past interest rate hikes have worked in favor of the Australian economy. Still, it appears that inflationary pressures are far from over as the Australian economy experienced notable setbacks. That said, the inflation rate in Australia is “still too high,” according to the RBA. As such, all of these factors continue to weigh on the Australian economy.

Aussie Struggles to Keep Pace Following RBA Decision

It may not come as a surprise to learn that Central Banks’ decisions can have a direct impact on the markets and in particular the Forex front. As such, it seems that the RBA’s dovishness may have caused many to shy away from the Australian Dollar on Tuesday.

As a result, pairs like the AUD/USD (AUDUSD) fell by over 1.3% as of the time of the writing on Tuesday.

Lagarde’s Monday Suspense

Another potentially market-moving event for this week may have been the European Central Bank’s (ECB) President, Christine Lagarde’s, speech yesterday, on Monday, whereby she made the ECB’s upcoming monetary policy decisions even cloudier.

Ahead of next week’s ECB rate decision on Thursday, September 14th, many may be waiting eagerly to see how the Eurozone’s Central Bank will approach economic challenges and what monetary policy decisions will be made. Nonetheless, Lagarde refuses to give further clues as she stated in a seminar in London on Monday that “actions speak louder than words.”

Lagarde went on to explain that the ECB has already increased its “policy rates by a cumulative total of 425 basis points in the space of 12 months — a record pace in record time.” She also went on to explain that the Central Bank intends to get inflation back to the 2% target rate.

This speech comes against the backdrop of last week’s Euro Area’s inflation numbers release, which revealed that inflation fell slightly in August compared to July.

Still, despite Lagarde’s ambiguity, markets still have their own expectations for next week’s ECB meeting. Apparently, some are anticipating a raise of 25 bps.

Additionally, July’s ECB Consumer Expectations Survey was released today and showed that expectations regarding “economic growth over the next 12 months became slightly more negative, however, the expected unemployment rate in 12 months’ time was unchanged.” This report can also be important as the ECB usually refers to it in its discussions and meetings.

Whether or not the ECB will raise rates or keep them intact like many of its peers is yet to be determined. Traders will have to keep a close eye on next week’s meetings and any potential volatility-enhancing events to come in the next couple of days.

Conclusion

In conclusion, while this week is not yet finished, it appears that a combination of events has already had an impact on the markets. Traders, analysts, and even average consumers may want to keep track of news and events to gauge how the markets will respond in the future and gain insights into the potential direction of the economy.