July 2023’s Final Week: Key Economic Data Releases

July 2023 may be drawing closer to its end but the key economic releases and events that could shed light on the state of the economy and impact the trajectory of the markets are far from over.

This week, key events from global central banks’ rate decisions to US GDP and Eurozone and UK PMI releases are set to take place. Here’s what you need to expect on July 2023’s final and key economic events and how they might affect the markets:

Will the Fed Return to Its Hawkishness?

Perhaps among some of this week’s most anticipated events is the Federal Reserve’s FOMC meeting during which the world’s biggest economy’s central bank will decide on interest rates.

The Fed is expected to kick off its meeting on Tuesday, July 25th, and release its decision on Wednesday, July 26th. Despite the latest rate pause in June, this time around, the US central bank is expected to return to its hawkish rate-hiking monetary policy.

The news may not come as a surprise to some given the fact that Fed officials, including the Fed Chair, Jerome Powell, have expressed their concern regarding the persistent inflation. Powell explicitly said last month that “inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” and warned that further hikes are on the horizon.

Accordingly, in this week’s meeting, the Fed is expected to raise hikes by a quarter percentage point. If the predictions hold true then it would bring the Fed’s target range to 5.25%-5.50% which would be the highest rate recorded in 22 years.

In addition to this week’s expected hike, it may also be worth noting that the Fed is expected to raise rates again by a quarter-point in their upcoming meeting this year. US economists Anna Wong and Stuart Paul commented saying that “the Fed is all but certain to hike by 25 bps in July.” However, they stressed that other factors like last week’s US CPI report which showed a slowing in inflation rates may “bolster voices on the FOMC arguing that July’s hike should be the final one.”

Only time will tell whether or not the Fed will adhere to the expectations or will take a more toned-down approach that takes into account other factors like the latest CPI report in the US. (Source:Bloomberg)

ECB: Another Hawkish Central Bank?

Besides the Federal Reserve, investors may want to keep a keen eye on the ECB’s rate decision on Thursday, July 27th. It seems that the majority of market participants expect the European Central Bank (ECB) to raise rates in their July meeting in light of the fact that last month, ECB President, Christine Lagarde revealed that more hikes are warranted in order to tame inflation.

As such, the Eurozone’s central bank is expected to raise rates by 25 basis points in July’s meeting but whether or not it will sustain an aggressive hiking tone throughout the year is yet to be seen.

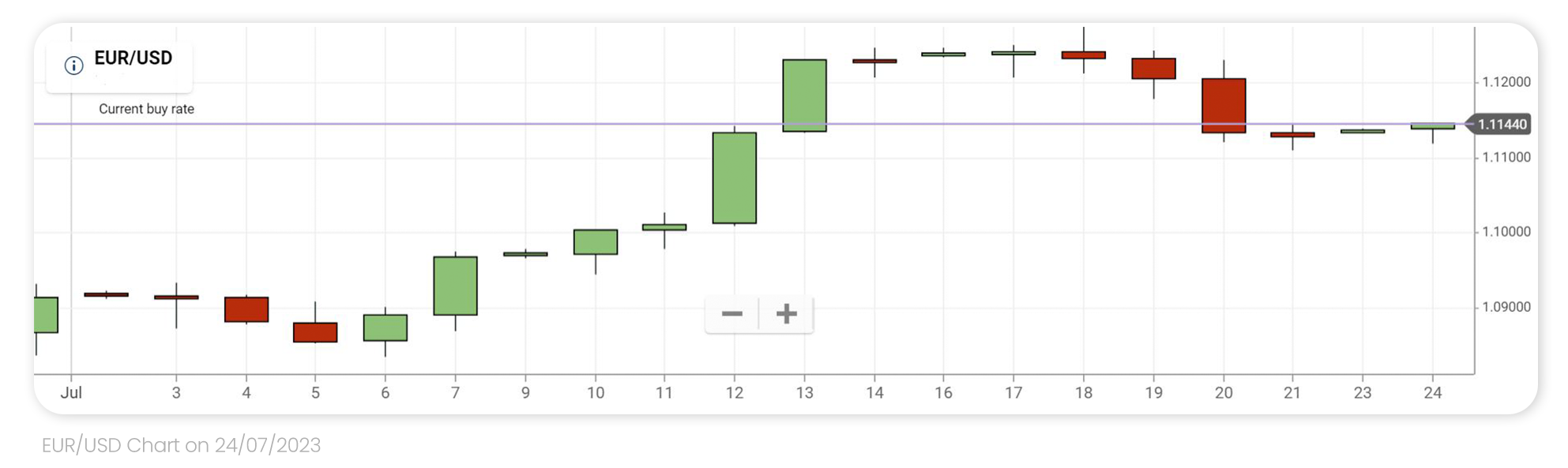

Naturally, the central bank’s decision can have significant implications for the Euro and the Forex markets. In case the ECB adopts a hawkish policy, then the Euro could strengthen. On the other hand, in case the ECB adopts a more dovish stance then the euro could weaken, which, in turn, could push the EUR/USD (EURUSD) pair lower.

Ahead of this week’s meeting and as of the time of the writing, Monday the EUR/USD is trading 0.06% higher perhaps sustaining the 2% it accumulated since July 2nd. Traders and investors may want to keep track of Wednesday’s Fed decision and Thursday’s ECB decision to see how these may affect this popular Forex pair’s value.

PMI Releases in the Eurozone and the UK

Ahead of the ECB’s rate decision is Monday’s Eurozone PMI release. The Purchasing Managers Index (PMI) measures a country’s manufacturing activity and highlights the health of a country’s economy.

Therefore, this economic measure can be an important one to both traders and policymakers. This month, the manufacturing sector is expected to come lower at 49.6 vs last month’s 49.9.

If these less-than-stellar predictions hold true then it only continues last month’s manufacturing drops. Some Oxford analysts contend that they “expect the eurozone composite PMI to fall further below the 50-point threshold that separates expansion from contraction.” In addition, they also stated that “taken at face value, this suggests there’s a considerable risk that eurozone GDP will contract in Q3 2023.”

Nonetheless, despite the PMI's role in affecting policymaking decisions, it is believed that this time around it will not have a big impact on the ECB’s rate decision to hike rates by an expected 25 basis points.

Traders may also be interested in Monday’s UK PMI which is also expected to drop. The expectations are that the UK PMI will drop to 45.9 from the prior 46.5. Moreover, some analysts believe that the Bank of England’s (BoE) likeliness to adopt a hawkish tone may have “reduced corporate confidence in the economic outlook over the next twelve months.”

BoE will meet on Thursday, August 3rd, so it will be interesting to see if today's PMI releases affect the bank's decisions. Other factors that may come into play are also June’s UK CPI data which was released on July 19th and showed that UK’s inflation fell to its lowest since March 2022.

US GDP: How Did the World’s Biggest Economy Fare in Q2?

The US GDP for Q2 is also expected to take place this week and can certainly provide valuable insight into the state of the world’s biggest economy and where it may be headed in the future.

Predictions suggest that US Q2 GDP is expected to come in at 1.8% Q/Q which is a tad below Q1’s 2% rate. According to Credit Suisse’s reports, consumer spending in Q2 may have slowed from Q1 due to higher borrowing costs. Demand for durable goods is also expected to have fallen this quarter. Traders will wait and see what the GDP report will reveal in the end.

Other events to keep track of are Friday’s Bank of Japan (BoJ) rate decision, during which the bank is expected to keep its rates unchanged, and Australia’s CPI release on Wednesday. In addition, a plethora of earnings reports are expected this week as companies from the Big Tech sector to the food and automotive industries will reveal how they fared in the second quarter of an economically-challenging year.

Overall, traders, investors, and analysts are in for an eventful week, and they will need to carefully observe the possible impact of each event on the markets and the overall economy.