Q3 Earnings Preview: Tesla, Netflix & Morgan Stanley

Q3 earnings season continues in full swing this week with reports from EV giant, Tesla, entertainment behemoth, Netflix, and big bank, Morgan Stanley.

These industry leaders are set to disclose their performance for the third quarter amid a challenging backdrop, with factors such as inflation, recession concerns, high interest rates, and ongoing geopolitical and economic turbulence exerting substantial pressure on the global economy and financial markets at large.

Here’s what you can expect from these companies’ earnings reports and what analysts think about this earnings season so far:

Is Tesla’s Battery Draining?

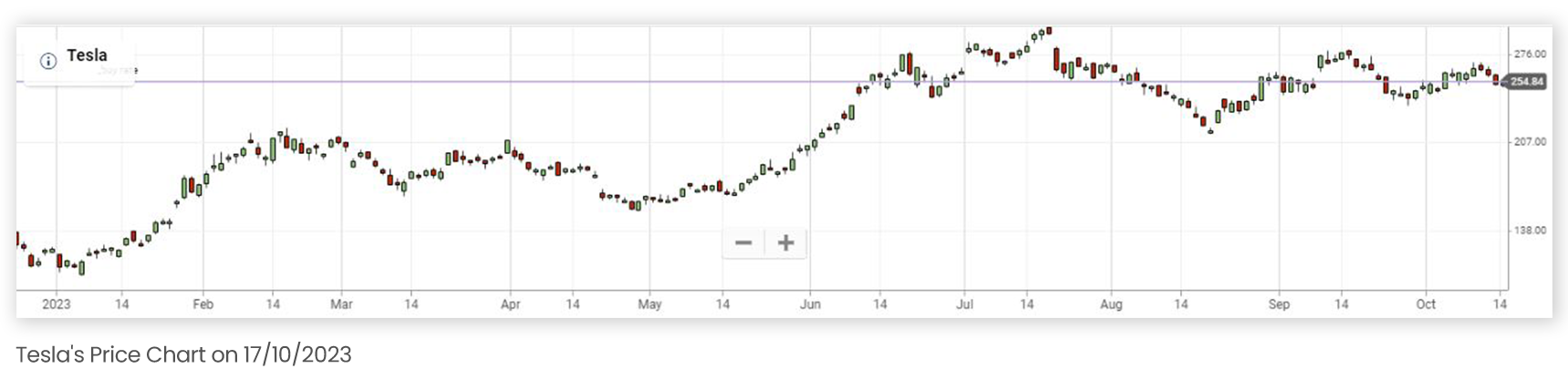

The fact that Tesla (TSLA) had quite a volatile year so far may not come as a surprise to avid market watchers as factors ranging from factory upgrades to poor consumer demand and rising competition put pressure on the EV giant’s deliveries and sales figures.

Just at the beginning of October, it was revealed that Tesla’s Q3 vehicle deliveries fell by 6% to 435,059, falling short of analyst expectations, and Q2’s 466,140 deliveries. These drops were attributed by CEO Elon Musk to factory downtime. Conversely, some of Tesla’s biggest rivals, like BYD (1211. HK), XPeng (XPEV), and NIO (NIO) reported record sales and deliveries.

Consequently, the anticipated figures for Tesla's upcoming earnings report on Wednesday, October 17 (after market close), have been declining since the previous year. According to some analysts, Tesla’s Earnings Per Share (EPS) is expected to drop -30.5% YoY. This bearish stance has been attributed to Tesla’s weakening profits due to price cuts, and manufacturing slowdowns, among other factors. On the flip side, Tesla Q3 sales are projected to increase by 13.6% YoY to land at $24.4 billion.

Still, despite this rollercoaster ride, it may be worth noting the fact that Tesla’s share price has risen 135% since the beginning of the year.

In addition, Tesla is expected to launch its Cybertruck vehicle before the end of the year, which can also influence its price and growth prospects.

As such, it is yet to be determined if these projects materialize and if or not Tesla will report improved results in the foreseeable future.

What's on Netflix's Next Episode?

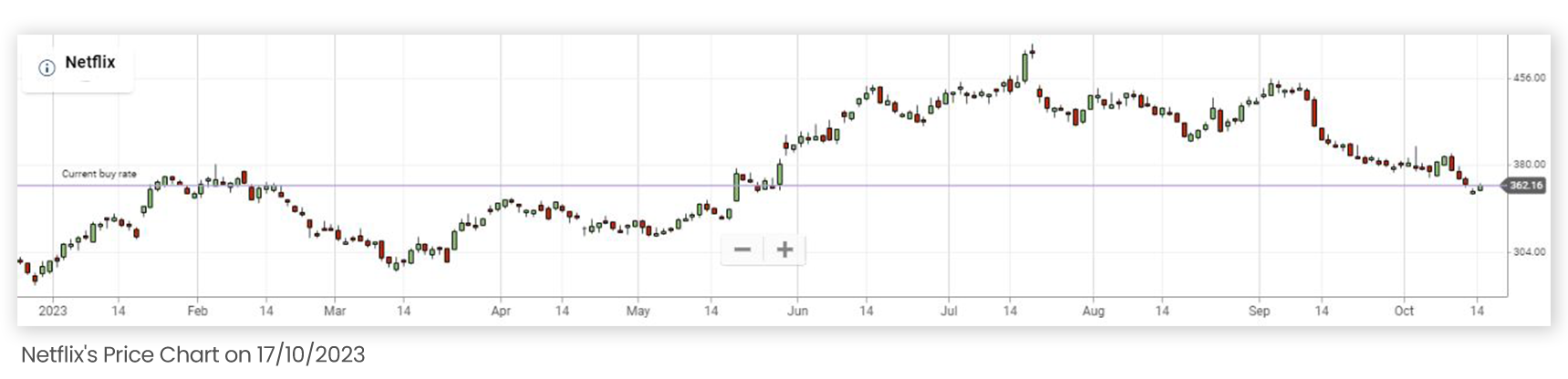

Streaming titan, Netflix (NFLX), is also expected to report its Q3 earnings on Wednesday, October 18, after the ring of the bell.

Among some of the key focus points for Netflix in Q3 was its emphasis on expanding its subscriber base to optimize earnings by implementing strategies such as raising prices, introducing an ad-supported service, and cracking down on shared accounts. Additionally, it seems that Netflix is planning to raise its streaming fees once more, beginning with the US and Canada in the coming months.

Still, despite these notable efforts, the outlook for tomorrow’s earnings is relatively weakening. According to analyst, Kannan Venkateshwar, “sentiment in Netflix is quite different from earlier in the year on the back of weak [average revenue per user] performance thus far in the year and continued expectation of weak pricing growth through the rest of this year despite some tailwind from the rollout of paid sharing.”

According to some analysts, Netflix is expected to report an EPS of $3.49, compared to last year’s $3.10. Additionally, the revenue is expected to rise to $8.54 billion, compared to the previous year's figure of $7.93 billion.

Additionally, just like Tesla, Netflix also had a volatile year, however, it still managed to gain over 22% since the start of 2023.

Big Bank Update: Morgan Stanley Earnings

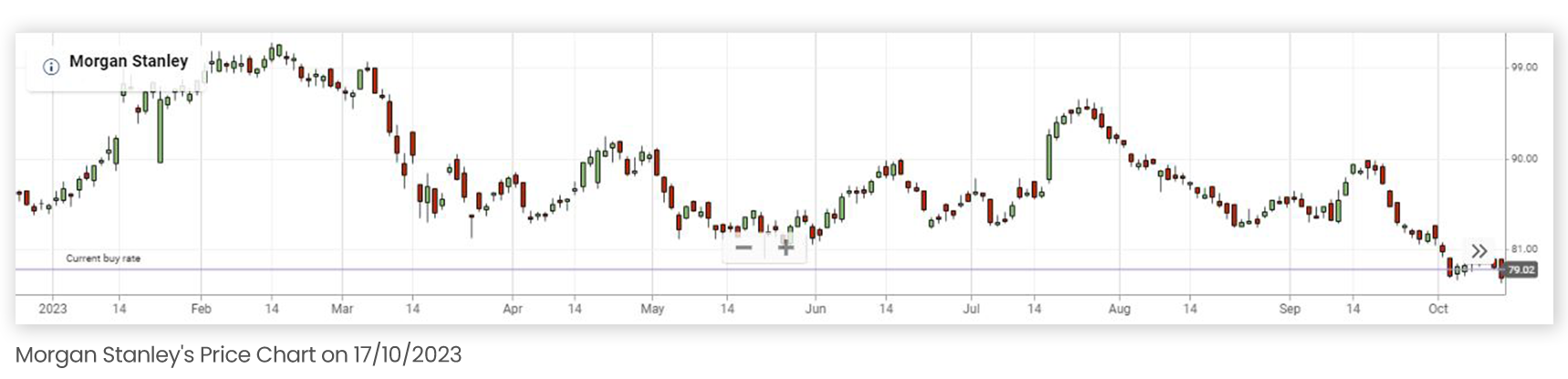

American multinational bank and financial services titan Morgan Stanley (MS) is scheduled to release its Q3 earnings on Wednesday, October 18, before market open.

Following a tumultuous year for the banking sector with major banks tumbling or announcing their bankruptcy, traders, analysts, and even consumers may want to keep track of Morgan Stanley’s report tomorrow, in order to get a better idea of what lies ahead for the banking industry.

Accordingly, it may not come as a surprise to learn that Morgan Stanley’s share price slid by 18.6% since the beginning of the year.

With that said, according to Zacks Consensus Estimate, the bank is expected to post a quarterly EPS of $1.32, reflecting a YoY decrease of -13.7%. On the other hand, revenue projections stand at $13.25 billion, marking a 2% increase compared to the same quarter last year. (Source:Yahoo Finance)

Traders will have to wait and see if these less-than-rosy projections come to fruition or if there will be an upward earnings surprise.

What Else Do Analysts Think?

It seems that despite the overall global macroeconomic uncertainty and despite initial projections of an earnings recession, many of the companies that have already reported their earnings have beaten Wall Street expectations, hence providing a “solid” start in the face of rising inflation and hawkish rate hikes. It will be interesting to see whether or not tomorrow’s releases will also provide a much-needed positive turn of events.

How Are the Markets Reacting?

On Monday, as investors and traders prepared for this week’s upcoming releases, leading Wall Street Indices edged higher.

The Nasdaq (US-TECH 100), the Dow Jones Industrial Average (USA 30 - Wall Street), and the S&P 500 (USA 500) rose 1.2%, 0.9%, and over 1% on Monday.

Despite these gains, elements such as geopolitical tensions emerging from the Middle East could play a pivotal role in shaping the market's future trajectory. Therefore, it is essential to stay informed about political and financial news and events to enhance your overall understanding of the markets.

What’s Possibly Lies Ahead?

Despite the prevailing global macroeconomic uncertainty and initial predictions of an earnings recession, numerous companies that have disclosed their earnings have exceeded Wall Street expectations.

This has resulted in a “solid” beginning amidst the challenges of inflation and hawkish rate hikes. It will be interesting to see whether or not tomorrow’s releases will also provide a much-needed positive turn of events.