Inflation, GDP & PMI: June 2023’s Last Economic Releases

June may have neared its end, but some key economic releases have not. From this week’s inflation data to PMI and GDP, traders and analysts alike may want to keep an eye out for the myriad of upcoming global economic releases that can shed light on the state of the economy and affect the course of the markets. Here’s what you can expect in the final week of June 2023:

US Data Releases: How Is the World’s Biggest Economy Faring?

This week, US personal consumption expenditures (PCE) will be released and might provide traders with much-needed guidance regarding any possible interest rate hikes in the world’s biggest economy.

The PCE which is reported by the Bureau of Economic Analysis, is otherwise referred to as “consumer spending.” This is because it gauges the spending habits of US citizens on goods and certain services. In addition, it is important to note that the Federal Reserve uses it in its decision-making process and can affect its rate-hiking policy and it is also deemed the central bank’s favorite inflation gauge.

Following the latest FOMC meeting on June 14th during which the Fed took a pause on hawkish rate hikes whilst simultaneously signaling possible hikes to come in the near future, this week’s US PCE data may provide valuable insight as to where the economy is headed.

As such, traders and consumers may want to keep track of this week’s US PCE data which is scheduled to be released on Friday, the 30th of June. Usually, higher PCE levels indicate that consumers are spending more on services and products and vice-versa. As for May’s PCE levels which will be released this Friday, expectations come in at 3.8% which is lower than April’s 4.4%. If these expectations hold true, it could indicate that consumers are spending less money.

In addition, before the PCE release, the US Q1 GDP reading is scheduled to be released on Thursday, June 29th. With the US economy having been under pressure along with the other global economies, and the possibility of a recession looming larger on it, the GDP figures can also play a key role in how the US economy progresses in the months to come and can also affect the Fed’s policies.

Eurozone Data: Has Inflation Moved out of the Bloc?

Friday not only marks an important day for the US economy but also for the Eurozone. This is because, on Friday, June 30th, the Eurozone’s June preliminary inflation data will be released and can also affect the European Central Bank’s (ECB) monetary policy.

This release may be especially important in light of the fact that whereas headline inflation is expected to show a slight easing in the Euro Area, the ECB has still shown a hawkish approach as underlying inflation continues to edge higher.

In the ECB’s latest meeting on June 15th, ECB’s President, Christine Lagarde, further interest rate hikes are still warranted and that inflation needs to be brought down to the ECB’s 2% target.

Today, Tuesday, June 27th, in her speech on “Breaking the Presence of Inflation,” at the ECB Forum on Central Banking 2023 in Portugal, Lagarade also stated that “inflation in the Euro Area is too high and is set to remain so for too long. But the nature of inflation challenges in the Euro Area is changing.” She also stated that the ECB has “made significant progress but – faced with a more persistent inflation process – we cannot waver, and we cannot declare victory yet,” and that interest rates will continue to remain “at those levels for as long as necessary.”

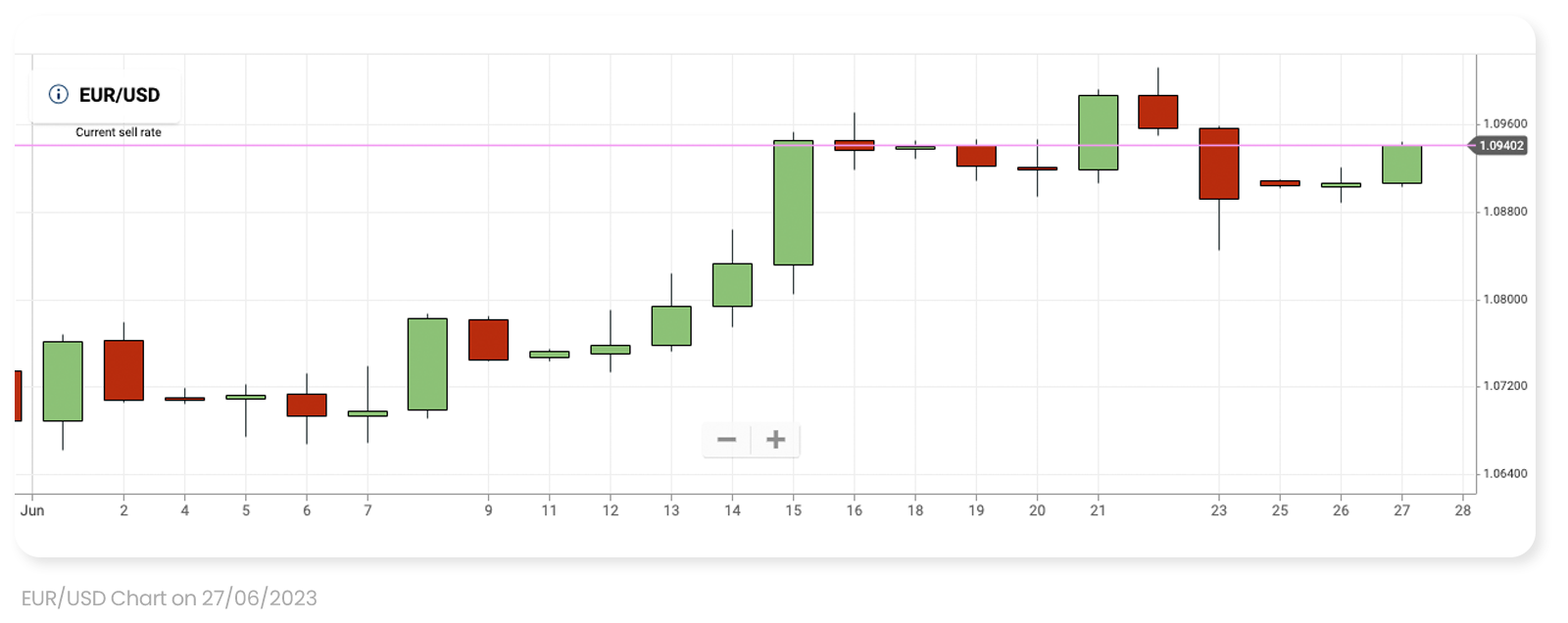

As many traders were already expecting further rate hikes in July, Lagarde’s commentary and the upcoming inflation data may only increase this possibility. Furthermore, naturally, these releases and remarks can affect the value of the Euro and the Forex market. The reason for this is that, in general, higher interest rates can increase the purchasing power of the euro and vice-versa.

Accordingly, as of the time of the writing, the euro hit a 2-day high while the EUR/USD pair has gained about 0.3% perhaps continuing the winning streak it has been experiencing since the beginning of the month as it gained 1.6% so far. Whether or not the euro will sustain this growth remains to be seen.

Has China Really Recovered From Its COVID Lows?

The world’s second-biggest economy is set to release its June PMI. The release is expected to show that China might actually be losing some of its post-COVID gains as recent economic data releases showed that the Chinese property market may be slumping and last month’s Chinese retail sales weakening, hence suggesting that the Chinese economy may be on the verge of deflation. Making matters worse for China, many banks lowered their GDP forecast for the year as signs of the Chinese economy weakening persisted.

Despite these less-than-stellar outlooks, ahead of Friday’s PMI release, and as of the time of the writing, Tuesday, China’s leading index, the Hong Kong 50 (HSI) which measures some of Hong Kong’s biggest shares, is actually 1.8% higher. (Source:Yahoo Finance)

In conclusion, keeping track of this week’s upcoming economic events may be prudent and can provide traders, investors, and analysts with much-needed insight regarding the state of the global economy and the markets.